Fasten your seatbelts. The global economic landscape currently feels less like a predictable journey and more like a high-speed rollercoaster, complete with dizzying drops and unexpected turns. For business leaders here in Malaysia, this ride can be unsettling. Decisions made thousands of miles away in Washington D.C., shifts in investor sentiment, and distant geopolitical tremors are sending ripples directly to our shores, impacting everything from the cost of goods to long-term investment plans. This climate of volatility isn’t just background noise; it’s a core challenge shaping the Malaysian business economic outlook. In this article, we’ll break down these complex forces, explore their direct consequences for local companies, and share our perspective on how to navigate this choppy environment with confidence and strategic foresight.

The Federal Reserve’s Far-Reaching Influence

It can seem strange that the decisions of the United States’ central bank, the Federal Reserve (the Fed), hold so much sway over our markets in Malaysia. The connection is quite direct. When the Fed raises interest rates to control its own inflation, it makes holding US dollars more attractive for global investors seeking higher returns. This creates a powerful magnet for capital, pulling money away from emerging markets, including ours. The result? A stronger US dollar and, consequently, a weaker Malaysian Ringgit. This isn’t just a number on a screen; it has real-world effects on the ground for businesses across the country. Conversely, even the slightest hint from the Fed that it might cut rates can send waves of optimism and capital flowing back into markets like ours.

Currency Fluctuations and Your Bottom Line

The direct impact of a volatile Ringgit is a double-edged sword for Malaysian businesses. For companies that import raw materials, components, or finished goods, a weaker Ringgit means higher costs. That new machinery from Germany or those components from China suddenly become more expensive, squeezing profit margins and forcing difficult decisions about whether to absorb the cost or pass it on to customers. On the other hand, exporters may find a weaker Ringgit gives them a competitive edge, as their products become cheaper for buyers using foreign currency. However, this benefit can be offset if they too rely on imported materials. This is a clear example of the global economic trends impact on Malaysia, forcing companies to constantly re-evaluate their pricing and supply chain strategies.

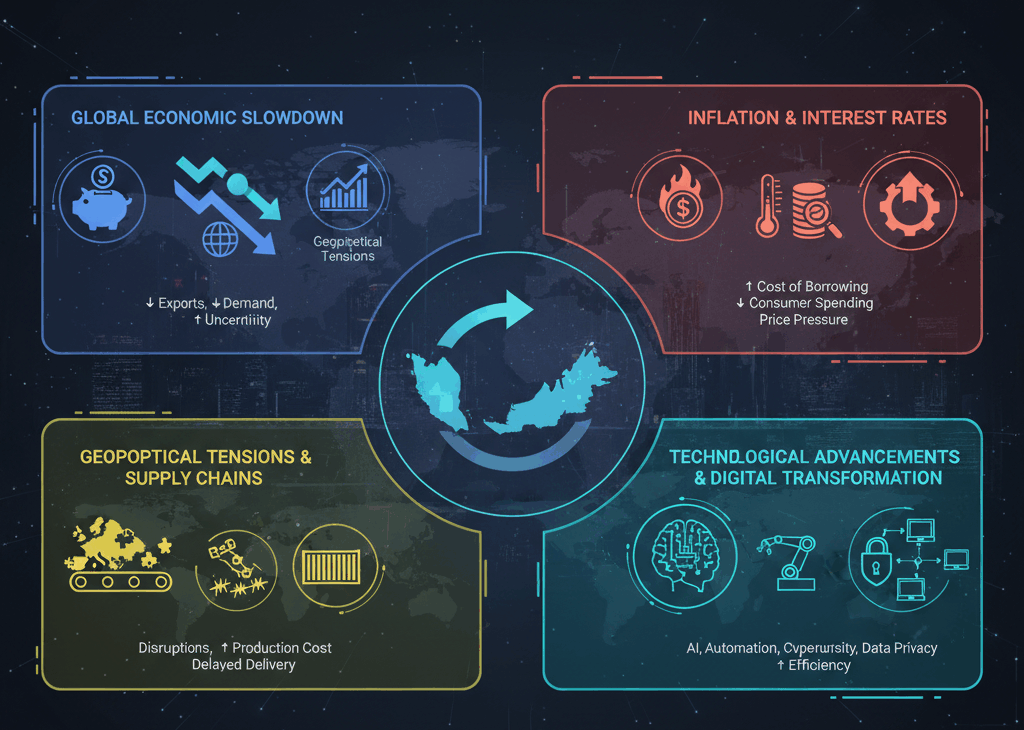

Uncertainty is the New Normal

Beyond currency, the atmosphere is thick with uncertainty. Will the Fed finally begin cutting interest rates, and if so, when and by how much? Each piece of economic data from the US is scrutinised for clues, creating a start-stop sentiment in global markets. Adding another layer of complexity are geopolitical developments. Events like the ongoing conflict in Ukraine or tensions in the Middle East might seem distant, but they have a direct line to our economy through their impact on energy prices, agricultural commodities, and overall supply chain stability. A sudden spike in oil prices, for example, raises logistics and operational costs for nearly every business in Malaysia. Navigating this requires a forward-looking perspective, not just a reaction to yesterday’s news.

The Critical Need for Business Agility

In an environment defined by rapid change, waiting to see what happens is no longer a viable strategy. Agility is the key to survival and growth. This means actively monitoring these global economic indicators and building resilience into your business model. Are you overly reliant on a single supplier or market? Now is the time to explore diversification. Have you considered financial tools to hedge against currency fluctuations? It may be worth a conversation with your bank. Building a strong cash reserve to weather unexpected cost increases or a temporary dip in demand can provide the buffer needed to make calm, strategic decisions instead of panicked, reactive ones. This proactive stance is essential when considering the global economic trends impact on Malaysia and your company’s place within it.

Turning Risk into Opportunity

To conclude, the current global economic rollercoaster presents undeniable challenges. The ripple effects of Federal Reserve policies, fluctuating currency rates, and geopolitical instability demand constant attention from Malaysian business leaders. However, acknowledging these challenges is the first step towards mastering them. By understanding these complex interconnections, you empower yourself to move from a defensive position to an offensive one. A deep and ongoing analysis of the Malaysian business economic outlook allows you to anticipate shifts, protect your operations from volatility, and even identify new opportunities that others might miss. In every period of uncertainty, there are openings for agile, informed, and resilient businesses to not only navigate the storm but to emerge from it stronger than before.