The economic winds are shifting, and for every business owner in Malaysia, the question is not if we will feel the currents, but how we will adjust our sails. A quiet signal from the US Federal Reserve about potential interest rate changes is creating ripples that will soon reach our shores. This is more than just financial news; it represents a new crossroads for our enterprises. Successfully navigating this landscape means looking beyond the headlines and understanding the real-world implications for our operations, our investments, and our growth. In the coming year, preparedness will be our greatest asset. This article will explore these changes, offering practical insights into the opportunities in technology and international trade, and underlining why solid financial planning for Malaysian SMEs is the compass we all need to guide us through 2025.

The Ripple Effect: What US Interest Rate Shifts Mean for You

When the US Federal Reserve talks, the world listens. Their hints at potential interest rate cuts are not just abstract economic theory; they have a direct impact on Malaysian businesses. A lower interest rate in the US can lead to a weaker American dollar. For our local exporters, this is potentially great news. Your products and services become more affordable—and therefore more attractive—to international buyers. This could be the perfect time to think about expanding your reach into new markets.

On the flip side, these shifts affect the cost of borrowing and the flow of investments. It might become cheaper to finance expansion, but it also changes the game for where international investors park their money. Understanding this dynamic is key. It’s a good moment to review any existing business loans and to speak with financial advisors about how currency fluctuations could impact your bottom line. It’s not about fearing the change, but about harnessing its momentum.

Capitalising on the Digital Finance Boom

Parallel to these economic shifts, another revolution is well underway: the explosion of financial technology, or fintech. For Malaysian businesses, this is no longer a trend to watch, but a tool to use. The rise of sophisticated yet user-friendly trading platforms gives businesses direct access to financial markets, allowing for better management of commodities and currencies.

Beyond trading, fintech offers incredible solutions to streamline your daily operations. Think of digital payment gateways that simplify customer transactions, online invoicing software that chases payments for you, and alternative lending platforms that offer financing outside traditional banks. By embracing these technologies, you can improve cash flow, reduce administrative burdens, and make your business more efficient and resilient. It’s about working smarter, not just harder, in this new economic climate.

Recalibrating Your Global Trade Compass

The changing economic landscape calls for a fresh look at your international strategy. The combination of currency fluctuations and the ongoing evolution of global supply chains presents both challenges and exciting opportunities. Is your business overly reliant on a single country for its supplies or its sales? Now is the time to diversify.

This is a critical component of building your Malaysian business strategies 2025. Explore alternative suppliers from different regions to protect yourself from bottlenecks. Research new export markets that may become more profitable due to currency advantages. Technology can be your greatest ally here, with platforms available to help manage logistics, track shipments, and connect with new international partners. A proactive approach to global trade will not just safeguard your business; it will position you to thrive amidst the changes.

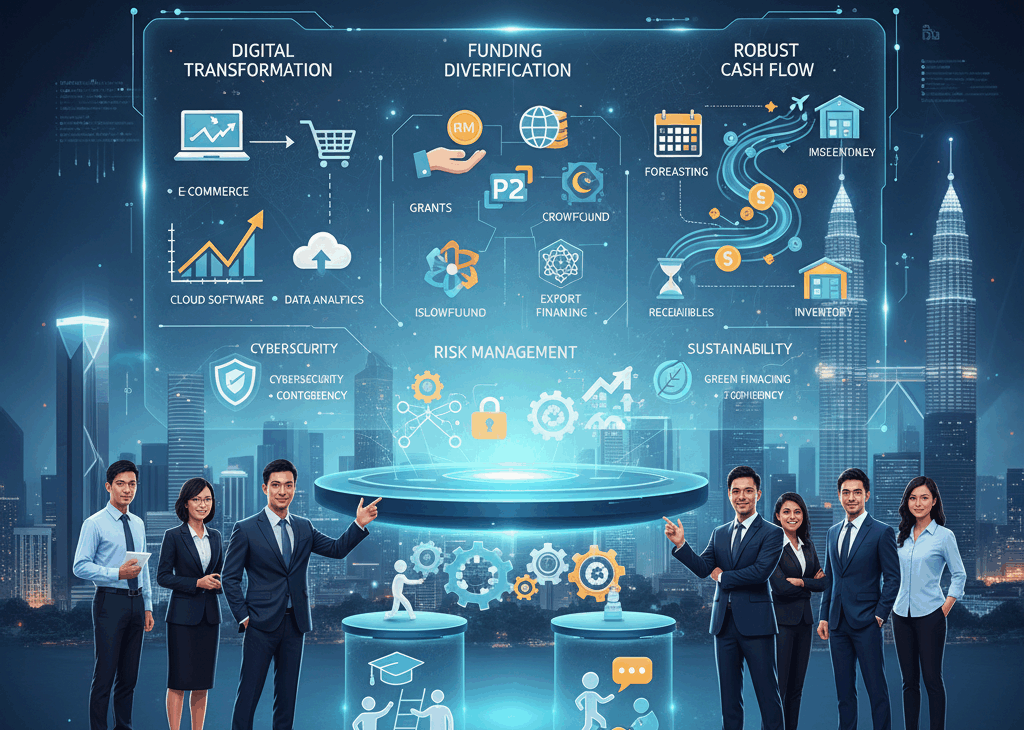

Building Resilience: Practical Steps for the Road Ahead

Adaptability is the new currency of success. To navigate the coming months, we must reinforce our businesses from the inside out. This begins with getting a firm grip on your finances. We encourage you to stress-test your business model. Ask yourself: how would a slight change in interest rates or a dip in sales affect our cash flow? Answering this question now gives you time to build a buffer.

This is where improved financial planning for Malaysian SMEs becomes non-negotiable. It’s about creating a clear budget, maintaining a healthy cash reserve, and having a plan for different economic scenarios. Secondly, foster agility in your operations. This could mean adopting cloud-based software that allows your team to work from anywhere or using flexible staffing to scale your workforce up or down as needed. Staying informed through reliable financial news sources will ensure you are never caught off guard. These proactive steps build a strong foundation, allowing your business to bend without breaking.

Charting Your Course for a Prosperous 2025

The economic shifts on the horizon are not something to be feared. Instead, we should view them as an invitation to innovate, adapt, and grow. For Malaysian businesses, this is a moment of opportunity. By understanding the real-world impact of global interest rate changes, we can turn currency fluctuations into a competitive advantage. By embracing the power of fintech, we can build leaner, more efficient operations. And by strategically diversifying our international trade relationships, we can open up new avenues for growth that we may not have considered before. True success in the coming year will not come from having a perfect crystal ball. It will come from being prepared, staying agile, and having the right tools and strategies in place. The strongest Malaysian business strategies 2025 will be those that are built on a foundation of resilience and a willingness to embrace change, ensuring we not only navigate the new crossroads but emerge stronger on the other side.